Portugal: The new incentive for scientific research and innovation (IFICI) was finally regulated

The IFICI is a tax incentive focused on attracting qualified talent to drive innovation and scientific research in Portugal.

The regulation of the new tax incentive for scientific research and innovation (dubbed as IFICI) has finally been approved, which became effective since the beginning of 2024.

This incentive was created by the State Budget law for 2024, and succeeds the so-called “non-habitual residents” regime (NHRs) that was in force until the end of 2023, with transitional application still in 2024 in some cases. Is established in article 58-A of the Tax Benefits Code and now regulated in Ordinance no. 352/2024/1, of December 23.

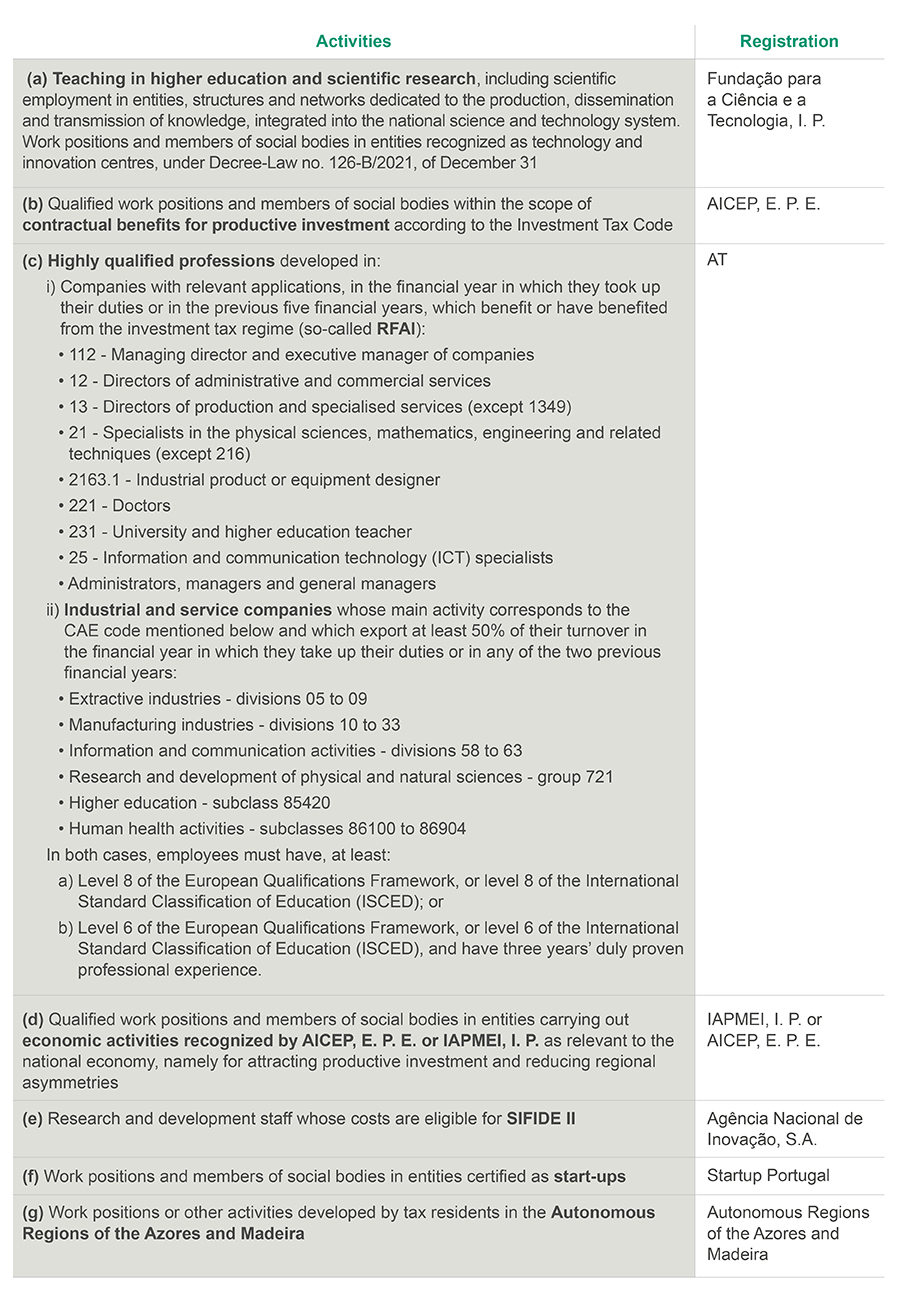

The application of the IFICI is more limited than the previous NHR regime, restricted to individuals who become resident in Portugal to carry out scientific research and innovation activities. Is dependent on prior registration duly documented before the Portuguese Tax Authority (AT) or the entities listed below, as well as on accreditation by the respective employers or those contracting their services.

Registration

The registration request must be submitted by January 15 of the following year in which they become residents in Portugal, through an official form yet to be approved by the Portuguese Government.

Individuals who become residents in the Portuguese territory in 2024 can submit the request until March 15, 2025.

Benefits

Individuals who become residents in Portugal, who have not resided here in the previous five years, can benefit under this incentive for a period of 10 consecutive years:

- From the application of a special Personal Income Tax (IRS) rate of 20% on employment income (category A) and professional income (category B) obtained in the Portuguese territory;

- From IRS exemption on income obtained abroad referring to categories A (dependent work), B (professional activities), E (capital income), F (rental income) and G (capital gains), being, however, compulsorily aggregated for the purpose of determining the rate to be applied to the remaining income.

Eligible activities

These entities must electronically communicate to the AT, by February 15 of each year, the registration requests and respective changes that have been submitted to them. Regarding taxpayers who become residents in 2024, this communication can be fulfilled until April 15, 2025.

Subsequently, the AT provides taxpayers, by March 31 of each year, with information about their registration in the IFICI which, in the case of individuals who become residents in 2024, must be made available by April 30, 2025.

Necessary documentation for registration

- Copy of the employment contract (when applicable).

- Updated commercial certificate for members of the social body.

- Copy of the scholarship contract for scientific research activities.

- Proof of academic qualifications.

- Declaration issued by employers and those contracting the services of IFICI beneficiaries regarding the activities (b) to (e) indicated above.

- Other documents requested by the certifying entities.

Contacts