Spain: The contribution order for 2025 is published

The order establishes the maximum and minimum bases and contribution rates as of 1 January 2025, which are updated in accordance with the minimum interprofessional wage for 2025. The maximum contribution base is set at 4,909.50 euros per month.

On 25 February 2025, Order PJC/178/2025, of 25 February, by which the legal rules on Social Security contributions, unemployment, protection for cessation of activity, the Wage Guarantee Fund and vocational training are developed for the financial year 2025, was published, with effect from 1 January 2025.

The maximum and minimum contribution bases for 2025 are set as follows:

- The maximum base is EUR 4,909.50 per month.

- The minimum base is the minimum interprofessional wage in force at any given time, increased by one sixth, and may not be less than 1,381.20 euros, unless expressly provided otherwise.

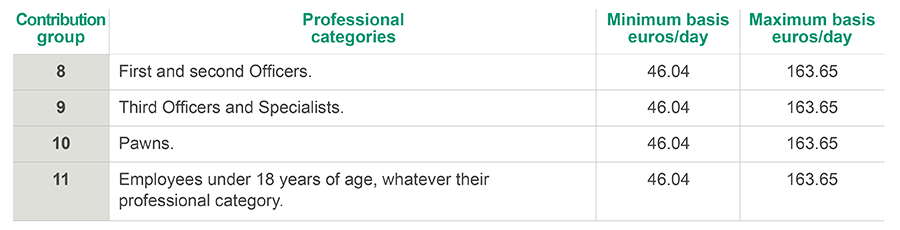

Specifically, the contribution to the General Scheme for common contingencies is limited for each group of professional categories by the following minimum and maximum bases:

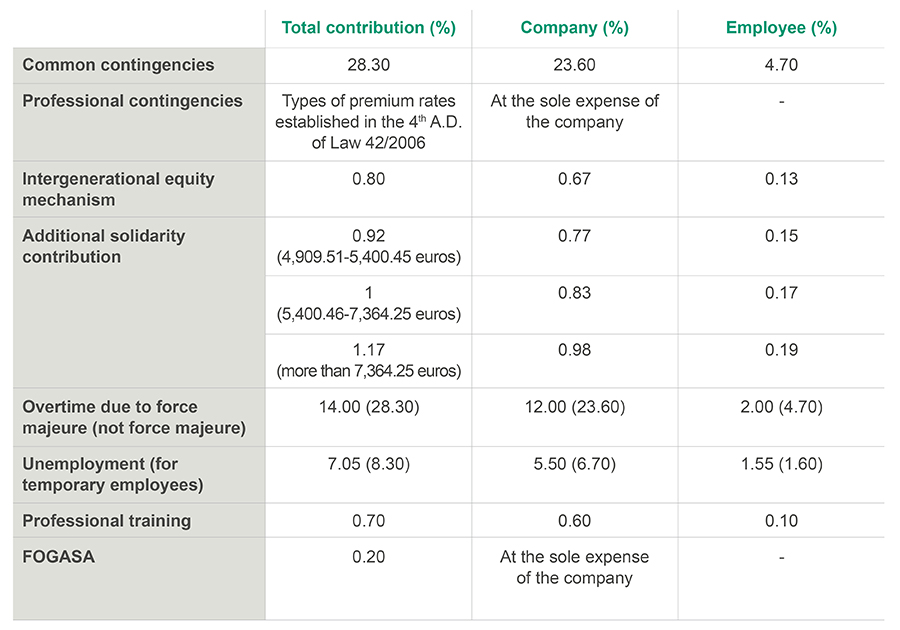

As for the contribution rates for common contingencies for the General Social Security Scheme, the rates applicable to date remain unchanged, with the additional contribution corresponding to the intergenerational equity mechanism being increased to 0.80%, and new elements being introduced, such as the additional solidarity contribution, with three progressive contribution rates depending on remuneration, or regarding situations of multi-employment.

The order also sets the minimum and maximum bases, as well as the contribution rates, for groups included in the General Scheme with specialities and for the special Social Security schemes (agricultural workers, seafarers, artists, bullfighting professionals, domestic workers, fresh tomato handling and packaging tasks, among others).

For self-employed workers, the contribution bases are based on net income and the maximum base for the last brackets (11 and 12) is also 4,909.50 euros/month.

Likewise, the amounts relating to certain specific situations are updated, including short-term temporary contracts, contracts for training and apprenticeship and work-linked training contracts, and external training or academic internships included in training programmes.

Contact